The Retreat from Hyper-Globalization

PUBLISHED on MEDIUM ON NOVEMBER 28, 2016

Flows of Goods and Services, People and Capital Have Overwhelmed the Ability of Political Processes to Accommodate Them

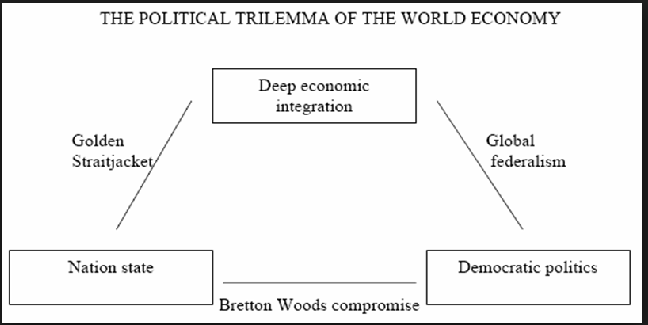

Over a short generation, digital technologies have radically reduced the frictions that inhibit the movement of goods and services, people, and capital. As defined by Dani Rodrik of Harvard’s Kennedy School, the result is a Political Trilemma: we can choose to maintain national autonomy, representative political institutions or deep economic and financial integration.

Rodrik spells out the conflicts:

“If we want to push globalization further, we have to give up either the nation state or democratic politics. If we want to maintain and deepen democracy, we have to choose between the nation state and international economic integration. And if we want to keep the nation state and self-determination. we have to choose between deepening democracy and deepening globalization….

“Even though it is possible to advance both democracy and globalization, the trilemma suggests this requires the creation of a global political community that is vastly more ambitious than anything we have seen to date or are likely to experience soon….

The extreme stress of the EuroZone, trapped between economic and financial integration while still struggling to maintain national autonomy with policy formulated by representative governments, is today’s paradigm example of the trilemma, with the status of Greece evidence of its immediate relevance.

For a long generation prior to the 1930s, the international gold standard had locked governments into a policy straight jacket, requiring action to punish the domestic economy whenever international movements of capital threatened to break the fixed exchange rate linking the local currency to gold. Thus, economic and financial integration trumped national autonomy during the first epoch of technology-driven globalization when the signal drivers were the railways, the telegraph and the steamship. Under the impact of the Great Depression, the gold standard collapsed and national governments — both representative as in the US and the UK and authoritarian as in Germany and Japan — chose autonomy in order to respond to the domestic impact of the world crisis.

During the first 30 years after the end of World War II, reflecting the hard-earned lessons of the 1930s, the “Bretton Woods Compromise” enabled both independent domestic economic policy and progressive reduction in restrictions on trade in goods and services by sanctioning government controls on the flow of capital. A measure of economic integration proved compatible with substantial autonomy in policy-making by representative governments.

But in the early 1970s, the Bretton Woods system broke down under the dual impact of the first oil crisis and the inflationary consequences of state underwriting of low unemployment. The open ground was seized by neoliberal advocates of market freedom as the overriding imperative, both economists (Milton Friedman) and politicians (Ronald Reagan and Margaret Thatcher). They ushered in a new regime of free capital movements and general deregulation, accompanied by floating exchange rates intended to preserve space for national autonomy in economic policy. But the result was an unsustainable acceleration of international flows of trade, people and money.

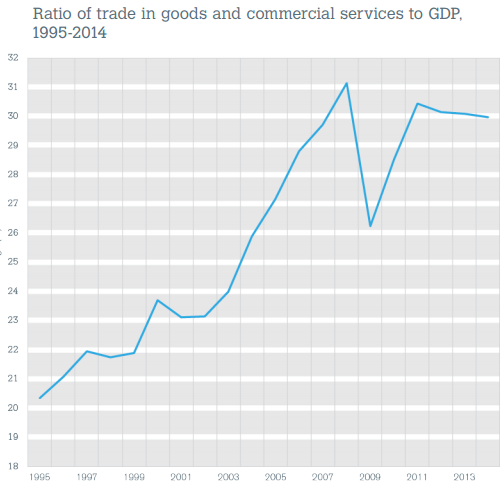

Let’s look at international trade in goods and services first:

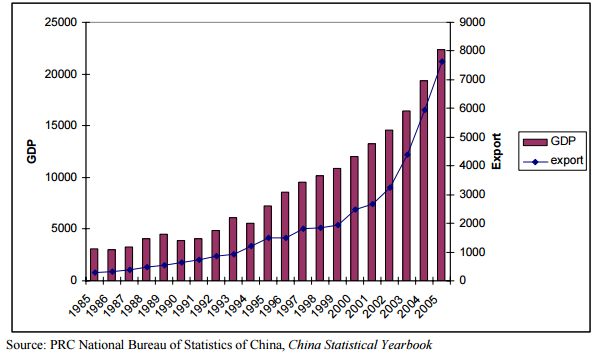

From 1995 to the onset of the Global Financial Crisis in 2007, the value of international trade rose from 20% of world GDP to almost one-third. The most dramatic factor , of course, was China’s entry into the world economy from the early 1980s, its unprecedented growth driven by exports:

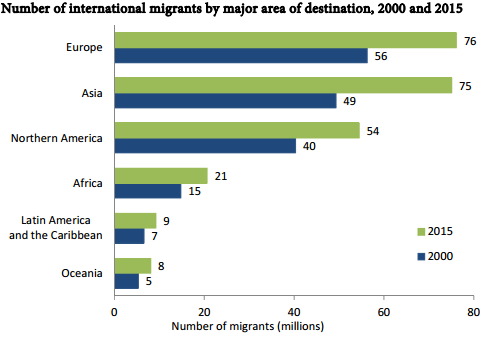

Then consider the movement of people:

Around the world, the number of resident international migrants has risen by 40–50% over the past 15 years.

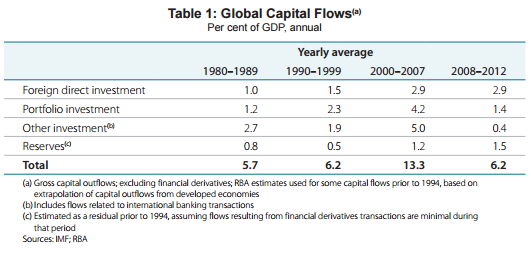

Finally, the IMF’s comprehensive measure of international capital flows over the past generation shows modest growth in average annual movements through the 1980s and 1990s and then explosive growth after 2000, especially in relatively liquid (i.e., easy to withdraw) bank claims and portfolio investment. The Global Financial Crisis forced reversion to the mean, leaving economic devastation behind:

The most volatile and therefore dangerous flows of capital are represented by claims of banks on other banks. In the chart below, the thickness of the links measures the volume of the claims:

Thus, between 2002 and 2007 — just five years — US claims on European banks rose from $513 billion to $1.6 trillion; European claims on US banks rose from $1 trillion to $2.6 trillion. These flows were radically reversed in the Global Financial Crisis and generated the Great Recession.

These are the forces that combined to drive the Political Trilemma to the forefront of policy debate and public consciousness. Remember: you can have (1) deep economic and financial integration, (2) an autonomous nation-state and (3) responsive, representative government — two out of three. The wave of populism, simultaneously anti-elitist and nativist, that is surging across the US and Europe is evidence that the trilemma cannot be evaded.

Begin with the political impact of rising imports, as documented by David Autor of MIT and his colleagues:

“[W]e find strong evidence that congressional districts exposed to larger increases in import competition disproportionately removed moderate representatives from office in the 2000s. Trade-exposed districts initially in Republican hands become substantially more likely to elect a conservative Republican, while trade-exposed districts initially in Democratic hands become more likely to elect either a liberal Democrat or a conservative Republican.”

The economic argument for Free Trade goes back to Adam Smith and David Ricardo and is taken for granted in Economics text books. But the politics of Free Trade have been all too evident in this election cycle.

The international flow of people is politically even more sensitive, despite the demonstrable economic benefits that immigrants bring to the host country. There could scarcely be two more ideologically opposed think tanks than the right-wing Manhattan Institute and the left wing Economic Policy Institute. But on this subject they agree. The Manhattan Institute offers the assertion: “Immigration benefits the economy, and America must adopt more flexible immigration policies that spur growth.” And the Economic Policy Institute provides the evidence:

“For the United States as a whole, immigrants’ share of total output was about 14.7 percent over 2009–11. Note that this is actually larger than immigrants’ 13 percent share of the population….Immigrants…are disproportionately likely to be working and are concentrated among prime working ages. Indeed, despite being 13 percent of the population, immigrants comprise 16 percent of the labor force. Moreover,…the share of immigrant workers who own small businesses is slightly higher than the comparable share of U.S.-born workers.”

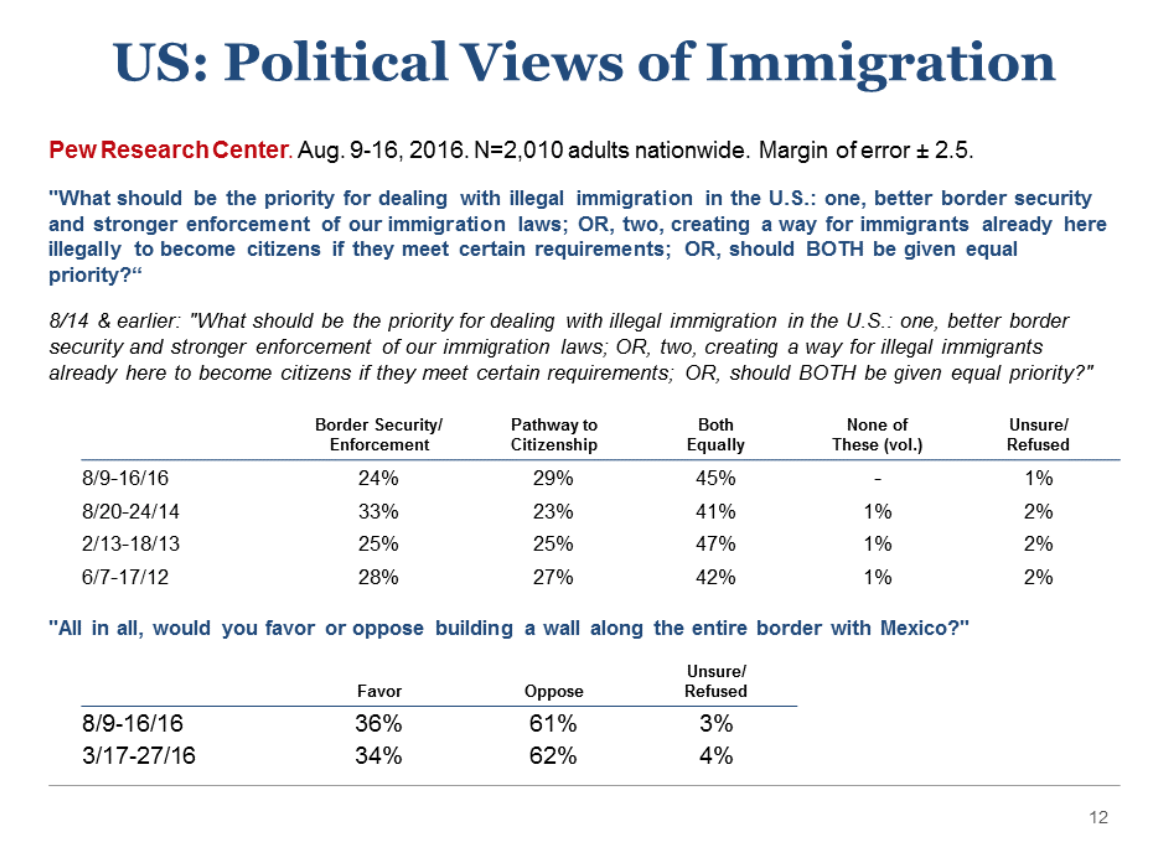

Surprisingly enough, despite the extreme rhetoric, American voters appear on balance to agree:

In 2016, three-fourths of those polled by the Pew Research Center included a “Path to Citizenship” among their preferred policies, up from less than two-thirds three years ago. And a clear majority do not want a “Wall.”

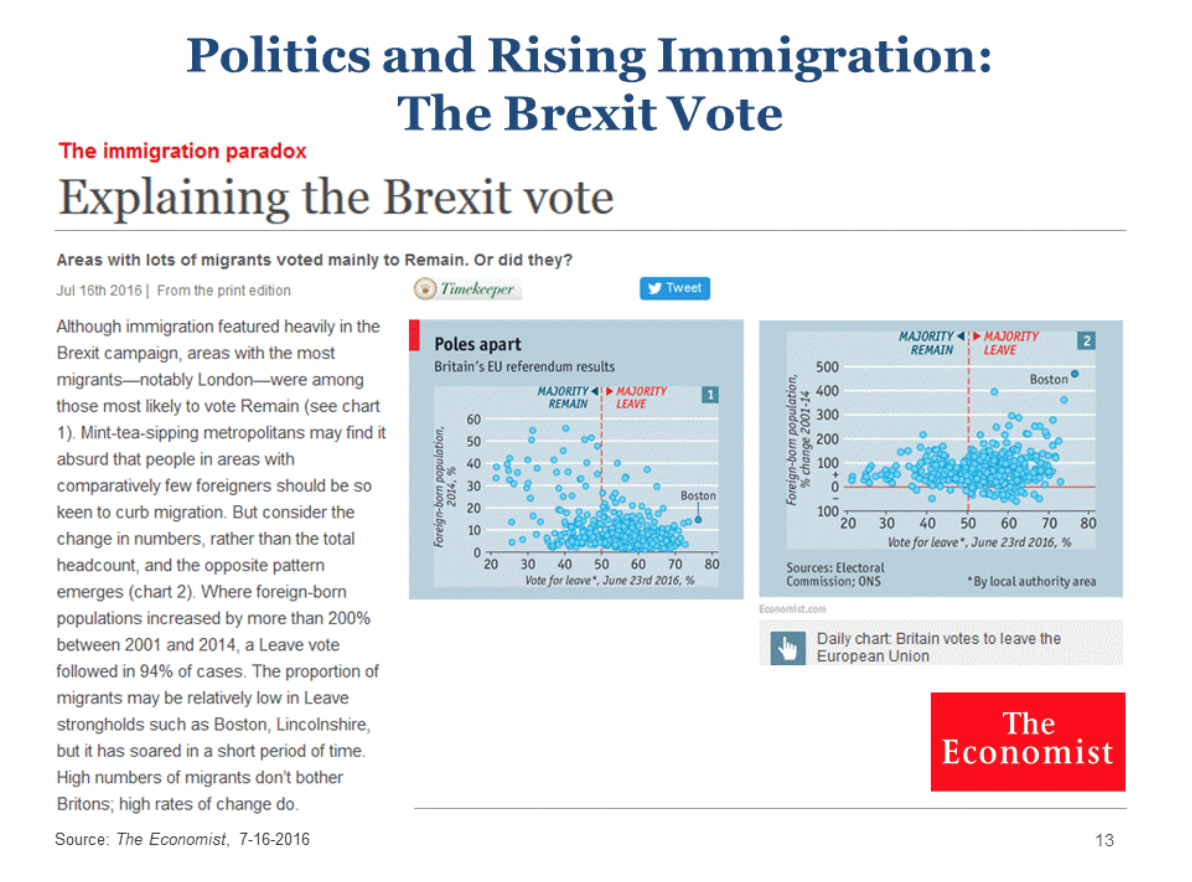

But, as The Economist illustrated graphically in its analysis of the Brexit vote, it is not that simple: it was the increased flow of immigrants to locales with relatively low immigrant populations that drove the Brexit vote in the UK: “High numbers of migrantsbb don’t bother Britons; high rates of change do.”

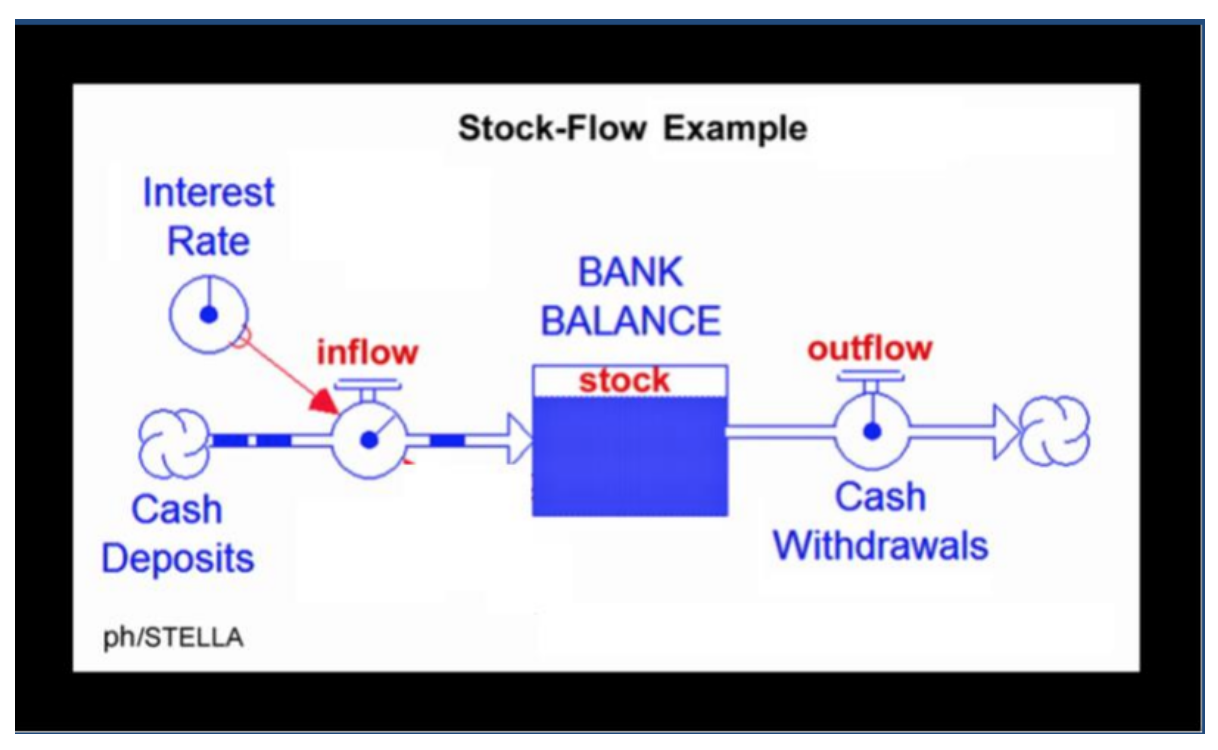

Unrestricted flows of trade, people and capital both exemplify extreme globalization and generate economic crisis and the consequent political backlash. This is where the critical role of “stocks” — inventories, reserves, reservoirs, sinks, pools — requires attention. Stocks decouple flows: they buffer the impact of changes in inputs to consequent outputs.

Here is a simple illustration showing how a bank balance buffers a change in income on spending:

The illustration is a building block of Systems Dynamics, an approach to understanding the nonlinear behaviour of complex systems over time using stocks, flows, internal feedback loops, and time delays. The methodology was developed at MIT in the 1960s under the leadership of the late Jay Forrester, who died on November 16, 2016 at the age of 98. I myself became fascinated with computers when, as a frustrated economist in the intellectual upheaval of the early 1970s, I discovered the Systems Dynamics approach to simulating the behavior of the economy.

The systemically crucial point is that holding stocks is inefficient but increases the robustness of the system, its resilience in response to an unexpected shock. Contrariwise, eliminating stocks increases the theoretical efficiency of the system’s allocation of resources (if we can assume away the threat of the unexpected) but increases the system’s fragility

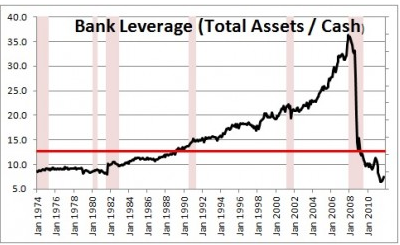

The disruptive impact of capital flows was demonstrated by the Global Financial Crisis. Nowhere are stabilizing stocks more needed than in the global financial system. The profile of the great Credit Bubble and Crash can be read off this chart:

Bank capital is the buffer stock that exists to protect the financial system against shocks: financial shocks, economic shocks, political shocks. Bank leverage is the ration of assets to that capital. For each bank, increasing leverage increases its efficiency: each dollar of capital supports more loans and other assets and generates more income in absolute terms and higher returns on capital (and, yes, higher bonuses). For the system, increasing leverage reduces the robustness of the system, especially since bank claims are inevitably short-term and subject to rapid reversal.

The flows of money are not alone in generating buffering stocks after they have first generated a crisis. Here is what a “stock” of people looks like: the Zaatari Camp for Syrian Refugees that holds some 80,000 people.

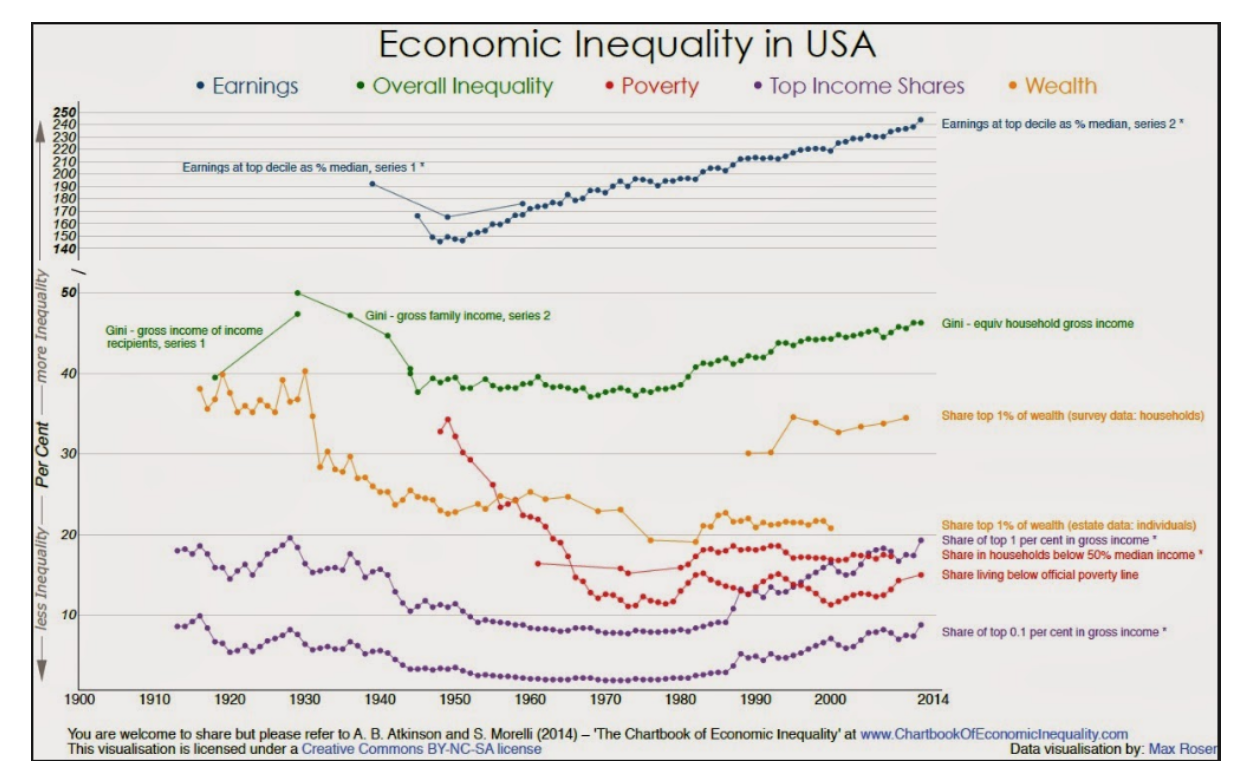

Of course, there is another and crucial dimension in which hyper-globalization has generated political stress. For the benefits of the flows and the costs for those unprotected from them have been most unequally shared. Here is a comprehensive set of measures of inequality for the United States, covering the decades since data became available through 2014:

If the virtue of economics is efficiency and that of politics is fairness, little wonder that large segments of the American electorate should have little regard for “the gains from trade” which too many economists simplistically celebrate. On the contrary, the cumulative political consequences of a generation of rising inequality have been increasingly visible since the credit bubble burst in 2008.

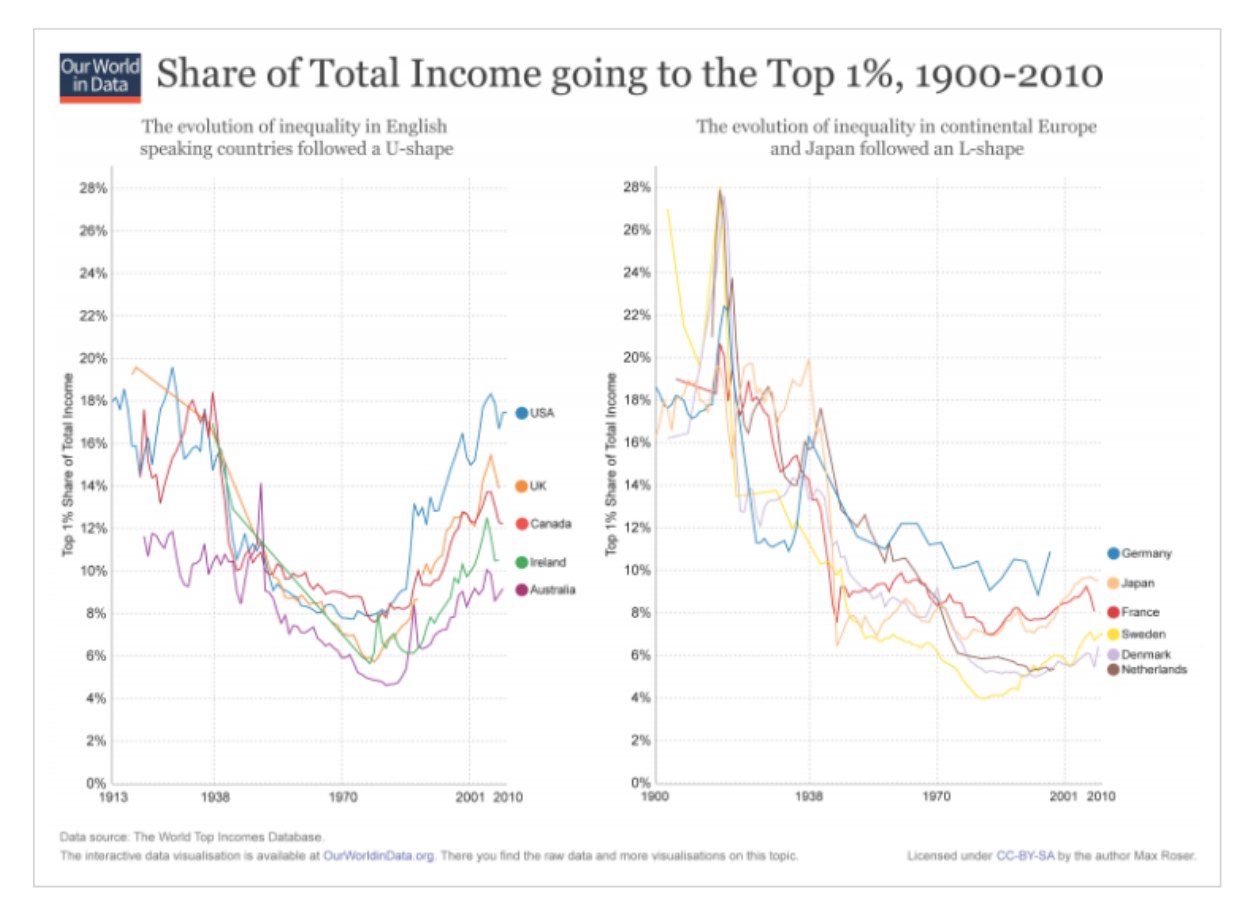

In truth, as these charts show, the English-speaking world appears substantially distinctive in its tolerance for the extremes of inequality relative to other developed nations:

And yet, as the rise of nativist movements across all of western Europe testifies, a significantly more comprehensive social safety net and more progressive tax regime does not insulate political elites from populist rebellion.

This is not the first time that the excessive flows of globalization have produced political crises and haphazard, unmanaged, disruptive and destructive retreat. Harold James of Princeton is the most distinguished historian of globalization: his book The End of Globalization analyzed the decline and collapse of the international political economy from 1914 through the Great Depression and World War II.

More recently, he reflected on “the phenomenon of globalization” which, he wrote, “has… become a ubiquitous way of understanding the world, but people who used the concept…failed to understand its volatility and instability.” Writing in the depth of the Global Financial Crisis, he emphasized:

“[G]lobalization generates continuous uncertainty about values, both in a monetary and a more fundamental (nonmonetary) sense.

“Globalization is vulnerable to periodic financial catastrophes which involve very sudden alterations of concepts of value….[O]ur values themselves are reevaluated….

Politics and economics are inextricably and inherently linked, and politics provides an alternative to market mechanisms for the management of global crises.

“When breakdowns occur, reconstruction is extremely difficult and involves a long and arduous effort for the rebuilding of social trust.”

Since 2009, when James summarized his understanding of globalization and its discontents, the “political alternative” briefly served the world well, putting a floor under the financial collapse and its economic consequences. And yet, by failing to do more to cushion and constrain globalization’s flows, those with political authority discredited themselves with constituencies large enough to drive the shocks of Brexit and the Trump election and to threaten more to come. Mark Blyth puts it this way, “The era of neoliberalism is over. The era of neonationalism has just begun.”